Instructions

Asset Declaration by Public Servants

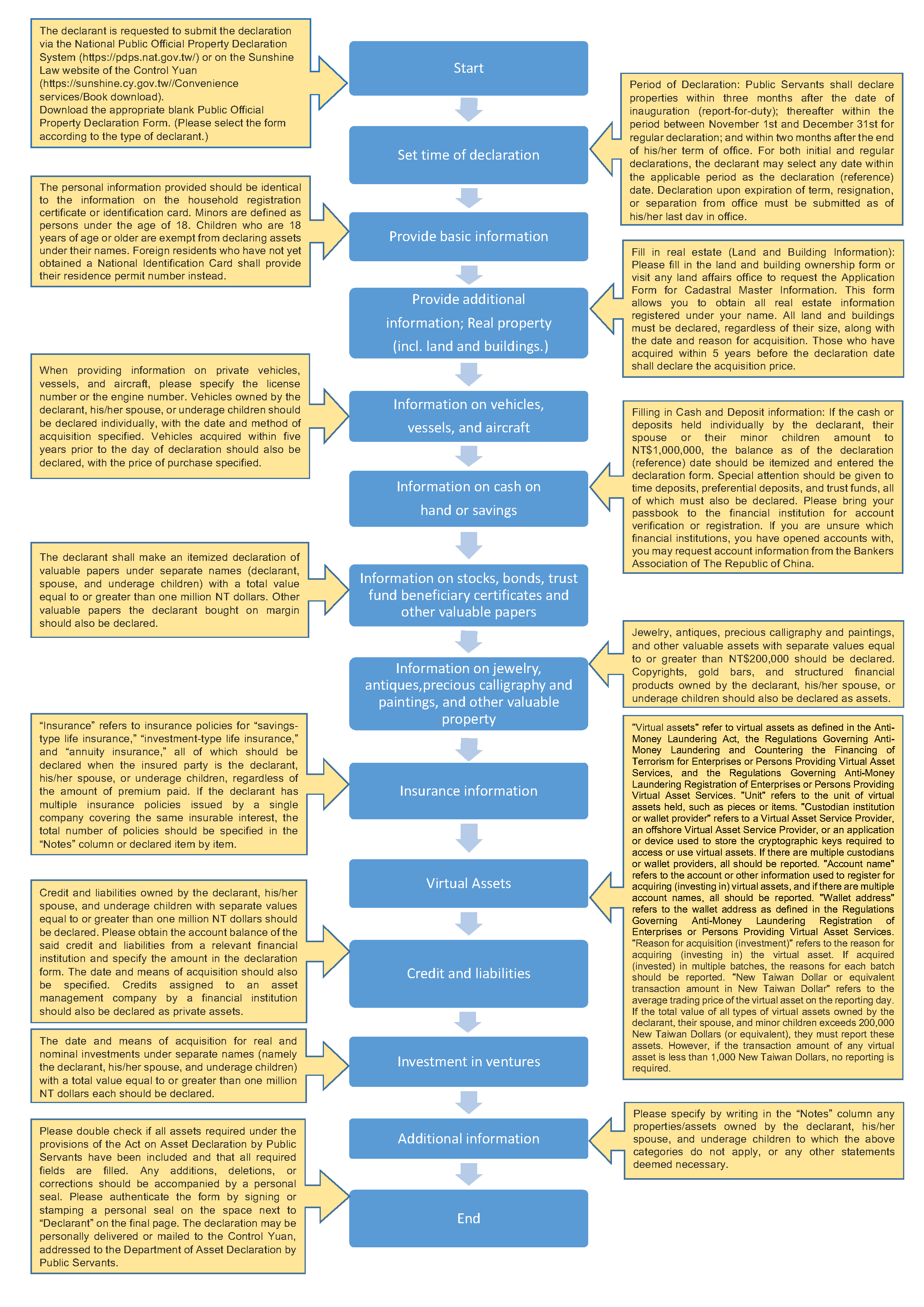

How to submit and accomplish asset declarations as required of public officials:

1. Form Filling: The declarant is requested to submit the declaration via the National Public Official Property Declaration System (https://pdps.nat.gov.tw/) or on the Sunshine Law website of the Control Yuan (https://sunshine.cy.gov.tw//Convenience services/Book download). Download the appropriate blank Public Official Property Declaration Form. (Please select the form according to the type of declarant.)

2. Period of Declaration: Public Servants shall declare properties within three months after the date of inauguration (report-for-duty); thereafter within the period between November 1st and December 31st for regular declaration; and within two months after the end of his/her term of office. For both initial and regular declarations, the declarant may select any date within the applicable period as the declaration (reference) date. Declaration upon expiration of term, resignation, or separation from office must be submitted as of his/her last day in office.

3. The personal information provided should be identical to the information on the household registration certificate or identification card. Minors are defined as persons under the age of 18. Children who are 18 years of age or older are exempt from declaring assets under their names. Foreign residents who have not yet obtained a National Identification Card shall provide their residence permit number instead.

4. Fill in real estate (Land and Building Information): Please fill in the land and building ownership form or visit any land affairs office to request the Application Form for Cadastral Master Information. This form allows you to obtain all real estate information registered under your name. All land and buildings must be declared, regardless of their size, along with the date and reason for acquisition. Those who have acquired within 5 years before the declaration date shall declare the acquisition price.

5. When providing information on private vehicles, vessels, and aircraft, please specify the license number or the engine number. Vehicles owned by the declarant, his/her spouse, or underage children should be declared individually, with the date and method of acquisition specified. Vehicles acquired within five years prior to the day of declaration should also be declared, with the price of purchase specified.

6. Filling in Cash and Deposit information: If the cash or deposits held individually by the declarant, their spouse or their minor children amount to NT$1,000,000, the balance as of the declaration (reference) date should be itemized and entered the declaration form. Special attention should be given to time deposits, preferential deposits, and trust funds, all of which must also be declared. Please bring your passbook to the financial institution for account verification or registration. If you are unsure which financial institutions, you have opened accounts with, you may request account information from the Bankers Association of The Republic of China.

7. The declarant shall make an itemized declaration of valuable papers under separate names (declarant, spouse, and underage children) with a total value equal to or greater than one million NT dollars. Other valuable papers the declarant bought on margin should also be declared.

8. Jewelry, antiques, precious calligraphy and paintings, and other valuable assets with separate values equal to or greater than NT$200,000 should be declared. Copyrights, gold bars, and structured financial products owned by the declarant, his/her spouse, or underage children should also be declared as assets.

9. “Insurance” refers to insurance policies for “savings-type life insurance,” “investment-type life insurance,” and “annuity insurance,” all of which should be declared when the insured party is the declarant, his/her spouse, or underage children, regardless of the amount of premium paid. If the declarant has multiple insurance policies issued by a single company covering the same insurable interest, the total number of policies should be specified in the “Notes” column or declared item by item.

10."Virtual assets" refer to virtual assets as defined in the Anti-Money Laundering Act, the Regulations Governing Anti-Money Laundering and Countering the Financing of Terrorism for Enterprises or Persons Providing Virtual Asset Services, and the Regulations Governing Anti-Money Laundering Registration of Enterprises or Persons Providing Virtual Asset Services. "Unit" refers to the unit of virtual assets held, such as pieces or items. "Custodian institution or wallet provider" refers to a Virtual Asset Service Provider, an offshore Virtual Asset Service Provider, or an application or device used to store the cryptographic keys required to access or use virtual assets. If there are multiple custodians or wallet providers, all should be reported. "Account name" refers to the account or other information used to register for acquiring (investing in) virtual assets, and if there are multiple account names, all should be reported. "Wallet address" refers to the wallet address as defined in the Regulations Governing Anti-Money Laundering Registration of Enterprises or Persons Providing Virtual Asset Services. "Reason for acquisition (investment)" refers to the reason for acquiring (investing in) the virtual asset. If acquired (invested) in multiple batches, the reasons for each batch should be reported. "New Taiwan Dollar or equivalent transaction amount in New Taiwan Dollar" refers to the average trading price of the virtual asset on the reporting day. If the total value of all types of virtual assets owned by the declarant, their spouse, and minor children exceeds 200,000 New Taiwan Dollars (or equivalent), they must report these assets. However, if the transaction amount of any virtual asset is less than 1,000 New Taiwan Dollars, no reporting is required.

11. Credit and liabilities owned by the declarant, his/her spouse, and underage children with separate values equal to or greater than one million NT dollars should be declared. Please obtain the account balance of the said credit and liabilities from a relevant financial institution and specify the amount in the declaration form. The date and means of acquisition should also be specified. Credits assigned to an asset management company by a financial institution should also be declared as private assets.

12. The date and means of acquisition for real and nominal investments under separate names (namely the declarant, his/her spouse, and underage children) with a total value equal to or greater than one million NT dollars each should be declared.

13. Please specify by writing in the “Notes” column any properties/assets owned by the declarant, his/her spouse, and underage children to which the above categories do not apply, or any other statements deemed necessary.

14. Please double check if all assets required under the provisions of the Act on Asset Declaration by Public Servants have been included and that all required fields are filled. Any additions, deletions, or corrections should be accompanied by a personal seal. Please authenticate the form by signing or stamping a personal seal on the space next to “Declarant” on the final page. The declaration may be personally delivered or mailed to the Control Yuan, addressed to the Department of Asset Declaration by Public Servants.